Crisis has both risk and opportunity!!!

Risk and opportunity from Crisis or correction

Those who has seen 2000 and 2008 meltdown knows what is crisis or correction. Prices start crashing in-front of your screen and as an investor you are helpless...Just hoping and pray that market should recover....

Similar thing is happening presently. There are some pockets which are down 70-80% from their 2018 peak prices.

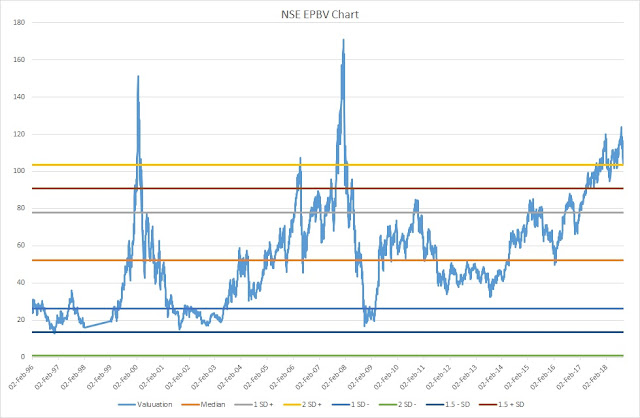

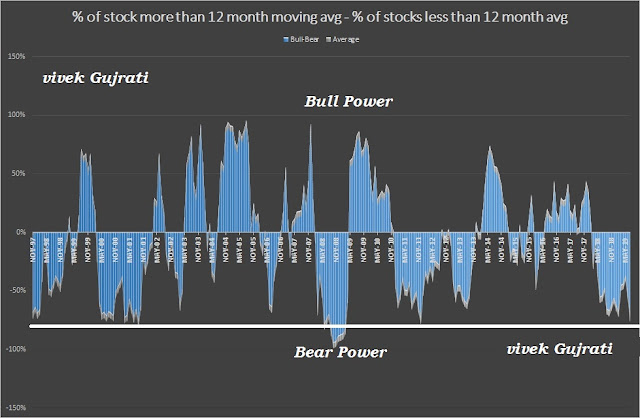

Whatever we call it, election fear, over valuation or bubble. The fact is stock prices was not growing in tandem to earnings so market started correcting the mistake. Mood swing is very common phenomenon for Mr. Market. It move in both the extreme because market movement. Sometime extreme optimism and sometime extreme pessimism due to behaviour of human being as we are the only force which drive the prices.

There are different kind of players in the market be it traders, investors, speculators, momentum chasers etc. and correction affect everybody.

Everybody tries to get the maximum benefit from falling market. As an investor, i think correction gives best opportunity to build the portfolio and offer great companies at throw away price.

No body can predict the depth of the crisis and period of crisis.

Stock market history suggest that depth of the crisis can be 80-90% (happened in US history) and period of crisis could be 26-30 years... 26-30 years period is very long period and that happened in US history in early of 19th Century and Japanese Market in at the end of 19th Century... Other than that we have not seen such long bear market in developed world market since 1900.

Indian market has seen depth of correction in previous two occasions (2000 and 2008) where entire market cap was down around 70-72%. and recovery was very fast.

Now if you believe India story is intact despite NPA, crude, IL&FS, currency, election etc etc...we may bounce back and will touch new high in coming years and this correction will passed away.

Now most important question, how to get the benefit of the correction??

Correction and crisis always throw lot of quality business at distress valuation and we should grab the opportunity to buy those business...

I will focus on followings business:

1. Products/services that are part of everyday consumption and not particularly discretionary.

2. Low debt ratios (including fixed commitments like lease and rentals) preferably and large cash balances.

3. Solid earnings numbers over the last 12 months.

4. Low EV/ EBIT multiple

5. Double digit return on capital

6. preferably 3 months ( maximum 4 months) operating cycle of the business so low working capital requirement

6. Medium to large market cap

7. High promoter stake (atleast 50%) and no pledging...

8. Solid cash flow from operation ( less divergence vis a vis EBIDTA atleast last 5 years)

I am trying to recession proof / election phobia (1) and pay a reasonable price (4) for a well-run company

(3 & 5) that also faces little danger from the credit squeeze (2 6 & 8) and promoter stake in the game.

My filtering process is on and I'll not hesitate to press button once I get the business defined above at my comfortable valuation.

Cheers....

..

Kindly request keep this blog active with regular posts ...

ReplyDelete