Indian Market- statistical valuation part 2

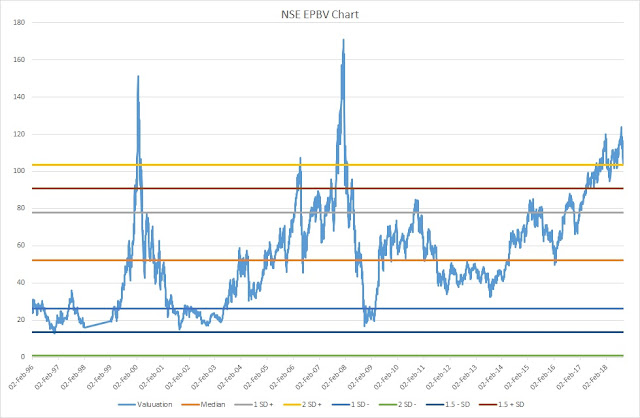

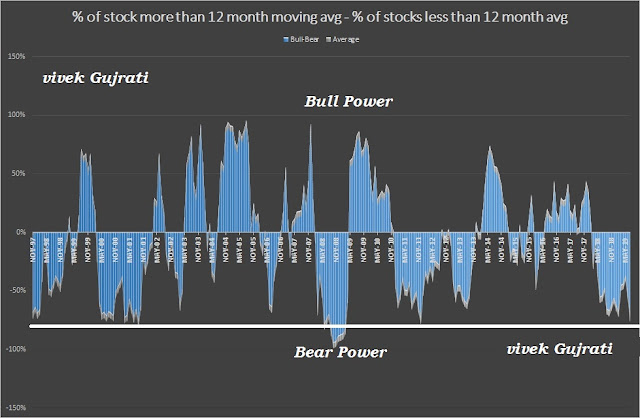

Indian Market : Statistical Valuation I wrote about statistical valuation on Sep 2018 ( http://tiny.cc/jk0paz). This is the updated version of the same. When I had written about statistical valuation, Small Cap and Mid Cap index level was 15239 and 15341 respectively. Presently, Small Cap and Mid Cap index closed 12,496.35 and 13,546.92 respectively, fallen 17% and 11% from 26th Sep 2018. Now Revisiting my updated analysis: 1. Bull or Bear Power: I've calculated the difference between no. of stocks more than 12 month moving avg vis a vis no. of stocks less than 12 month moving average. x The present fall is similar to 1997 as reflected in the above chart. As on 31st July, 15% BSE Listed stocks are above 12 months moving average while 85% BSE listed stocks are below 12 month moving average. The market power ( % of stocks above 12 month moving avg - % of stocks below 12 month moving avg) i.e. Bull or Bear decided b...